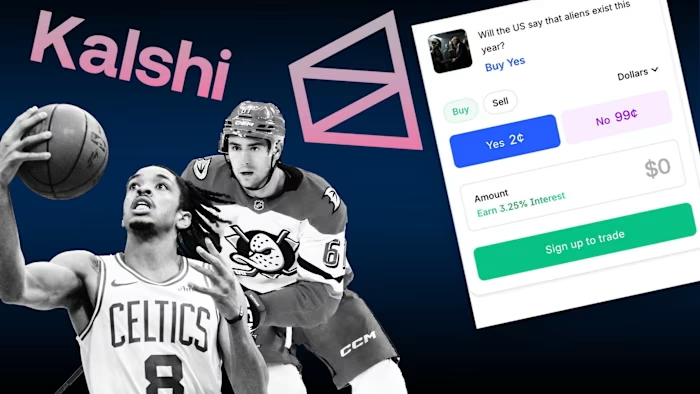

Kalshi and Polymarket race to crack ‘parlays’ as stakes rise in sports betting

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Kalshi and Polymarket are racing to build enough liquidity to offer lucrative multi-leg sports bets, as the fast-growing prediction market providers intensify their efforts to upend the $14bn US sports gambling industry.

The bets, known as “parlays” in the US and “accumulators” in the UK, deliver bettors a big payout if a series of wagers come good. But while they form a cornerstone of the mainstream sports gambling market, parlays are difficult for prediction markets to facilitate.

Prediction markets allow gamblers to bet on binary outcomes of future events, such as the result of a football match, with the prices and implied odds determined by how participants bet.

To offer parlays, prediction markets have to establish liquidity pools for each individual bet, whereas traditional gambling groups, such as DraftKings and FanDuel owner Flutter, can simply bundle preset odds.

“The current downfall [of prediction markets] is their inability to offer the same range of exotic bets that US gamblers love so much, like same-game parlays . . . but the market is beginning to find a way to serve certain sports,” said Adam Rivers, a managing director at consultancy Alvarez & Marsal.

In a research note, Bank of America Merrill Lynch analyst Shaun Kelley hailed parlays as the “killer app” of sports betting, saying they have “structurally changed” the industry’s win rates and economics.

While parlays are unlikely to be as lucrative for prediction market providers, which charge per transaction, as they are for conventional sportsbooks, they are still an opportunity to lure gamblers from conventional gambling companies.

Polymarket and Kalshi are offering incentives to traders who help build liquidity on their exchanges — which has become a strategic goal.

Kalshi, which offers individual liquidity providers payments of up to $1,000 per day, last year signed a partnership with Susquehanna International Group as its “first institutional market maker”.

Controversially, the company also operates an in-house unit, Kalshi Trading, which makes bets on the exchange. The practice has prompted a proposed class-action lawsuit from critics alleging it creates conflicts of interest and puts customers at a disadvantage. Kalshi co-founder Luana Lopes Lara has dismissed the lawsuit as “baseless”.

The popularity of prediction markets has exploded since they rose to prominence in the run-up to last year’s US presidential election.

Americans can use prediction markets to bet against each other on everything from the frequency of Elon Musk’s X posts to the likelihood of the US government announcing this year that aliens exist (current implied odds: 13 per cent).

Kalshi, which counts Donald Trump Jr as a strategic adviser, achieved an $11bn valuation in a $1bn funding round last month. Polymarket, where he is an investor, has recently been in talks to raise money at a valuation of between $12bn and $15bn.

In November Bank of America analysts estimated that prediction markets accounted for between 3 and 8 per cent of the US online sports betting market.

Sports betting groups DraftKings and Flutter have also launched their own prediction markets, although both companies only plan to offer such trading in US states where conventional online sports betting is prohibited.

In New Jersey, one of the few states that breaks down gambling revenues by type of bet, parlays accounted for 63 per cent of all revenues from online sports betting in the year to October.

Kalshi rolled out its first customisable parlay-style feature — called “combos” — to all users in December. In a post on LinkedIn, chief executive Tarek Mansour said these bets delivered more than $100mn in volume in a single week.

Polymarket, meanwhile, offers preset bundles of bets, largely outside of sport, but does not yet facilitate customisable parlays. On the social network Discord the company has offered a $50 bonus for the first user to submit any multi-leg bet that is launched on Polymarket.

Gambling bosses have been dismissive of these efforts. Flutter chief executive Peter Jackson said in an interview in November that punters will always prefer traditional sportsbooks because “you don’t have anywhere near the same breadth of choice [on a prediction market exchange]”.

DraftKings chief Jason Robins told investors in November that prediction markets were “structurally limited”, highlighting parlays in particular: “Just having to have individual liquidity pools makes it hard because then you spread out your liquidity.”